Posts Tagged ‘AIR’

Wednesday, November 19th, 2014

With the flexibility to be equipped on wheels, floats or skis and perfect for bush adventures or just cruising with friends and family, the Cessna 180 is one of the most versatile tail wheel aircraft. Introduced in 1953 and later dubbed the  “Skywagon” the Cessna 180 has been soaring through the skies as a pilot favorite for over 50 years.

“Skywagon” the Cessna 180 has been soaring through the skies as a pilot favorite for over 50 years.

If anyone doubts the capabilities of the Cessna 180, just let them know that the first woman to fly solo around the world did it in a Cessna 180. Geraldine “Jerrie” Mock departed in N1538C, The Spirit of Columbus, from Columbus, OH in April of 1964. Jerrie flew into the history books after 29 days of flying a total of 22,860 miles. The aircraft now hangs in the National Air and Space Museum.

“The Cessna 180 Skywagon is one of the best planes that Cessna has ever produced. Of all the aircraft I have owned over the years, the Cessna 180 is one of my favorites,” says Jon Harden, President of Aviation Insurance Resources (AIR) and member of the International 180/185 Club.

Aviation Insurance Resources (AIR) specializes in aircraft insurance. With over 34 years of aircraft insurance expertise, AIR will save you time and money on your Cessna 180 insurance. Just check out or ad in the Skywagon newsletter, or fill out an online quote request here!

To learn more about how Aviation Insurance Resources can assist you with your Cessna 180 Skywagon insurance please call 877-247-7767 or visit AIR PROS.com today and receive your insurance quote! You can also follow AIR on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, AIR-PROS, aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, aviation insurance, aviation insurance discounts, Aviation Insurance Resources, Cessna 180, Cessna 180 insurance, Cessna insurance, Cessna Skywagon, Cessna Skywagon Insurance

Posted in AIR-Pros News, Aviation Insurance, Cessna Aircraft Insurance | Comments Off on Insuring your Cessna 180 Skywagon

Tuesday, October 14th, 2014

Renting an aircraft or borrowing one from a friend comes with a lot of responsibility. A thorough pre-flight is important to ensure the previous pilot did not leave any damage. Maybe you need to get the aircraft back on time before the next pilot has signed up for it. Perhaps, the rule is to top the tank off after you land. Have you thought about if you are actually protected by the owner’s aircraft insurance?

When you rent or borrow an aircraft you may not be protected by the owner’s aircraft insurance policy (including your local FBO). If there is an accident you may be held legally liable for damages to the aircraft, or even worse, injuries to others out of your own pocket.

NEW: Easy Quote & Purchase Online

Aviation Insurance Resources (AIR) provides a full range of aircraft insurance, including non-owned insurance for aircraft renters. AIR prides itself in being a one stop shop for all things aviation insurance and now has just made purchasing non-owned aircraft insurance even easier!

AIR is excited to announce that non-owned aircraft insurance is now available to be purchased online directly through our website! Through a premier partnership with Starr Aviation, AIR offers personal non-owned aircraft liability protection in standard, experimental, multi-engine and helicopter aircraft! Pilots can now sign up and pay for insurance in an easy and secure policy porthole, receiving instant binder confirmation. To start coverage, simply visit our website and click on “non-owner” or follow this direct link.

Flight Instructors

Certified Flight Instructors (CFI) providing instruction in someone else’s aircraft could also be liable for the instruction they provide. CFI non-owned aircraft policies and the exclusive SAFE CFI member policies are now available to start coverage online as well!

Insurance Discounts

Flying safe can often lead to helpful discounts on your aircraft insurance and these are available online with just a click of a button! Discounts are available for pilots who are claim free, pilots who complete a phase in the WINGS pilot proficiency program prior to beginning coverage, and those who have completed the OpenAirplane Universal Pilot Checkout.

About Starr Aviation

With each team member, on average, enjoying over 15 years of aviation insurance experience, Starr Aviation is highly competent, allowing us to be a major provider of insurance for varying aircraft hull & liability risks. Starr offers comprehensive coverage for an extensive range of aircraft hull and liability exposure and our experienced underwriters develop programs tailored to each of these specific risks, including fixed and rotor wing aircraft for both commercial and corporate operations.

About Aviation Insurance Resources

Aviation Insurance Resources provides a full range of aircraft insurance and aviation insurance products to clients of all sizes. AIR represents all of the major insurance markets and offers the broadest package of protection and the best available rates. To learn more about the Aviation Insurance Resources, please call 877-247-7767 or visit AIR-PROS.com today and receive your aircraft insurance quote! You can also follow AIR on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, AIR-PROS, aircraft, aircraft insurance, aircraft insurance options, aviation insurance, aviation insurance discounts, Aviation Insurance Resources, non owned insurance, OpenAirplane discount, renters insurance, Starr Aviation, WINGS discount

Posted in AIR-Pros News, Aviation Insurance, Non Owned Insurance, Open Airplane | Comments Off on Aircraft Renter’s Insurance Made Easier

Monday, September 29th, 2014

New for this year, the Aircraft Owners and Pilot Association (AOPA) is hosting aviation fly-ins around the country to meet its members and to join pilots and aviation enthusiasts together. On Saturday, October 4th AOPA will have a homecoming celebration, bringing the fly-in back to Frederick Municipal Airport (KFDK) for the first time in five years.

The event takes off at 8:30am with a pancake breakfast (register here) and continues with a day of aircraft exhibits and free seminars. At 2:30pm AOPA president, Mark Baker, will conduct a Pilot Town Hall meeting. Other activities include flights in the EAA’s B-17 Flying Fortress (sign up here) and an aerobatic performance by Red Bull Air Race Champion pilot Michael Goulian. The event closes at 4pm.

Fun with Aviation Insurance Resources (AIR)

The aircraft insurance specialists at Aviation Insurance Resources (AIR) will have a booth and a cookout at the AOPA homecoming. Aviation plays an important role in the lives of the agents and pilots at AIR and those in the Frederick Home Office spend many a day flying (and hangar flying) out at KFDK.

All agents from the Frederick Home Office will be in attendance as well as Melissa McKinley, who manages the Bradford, Pennsylvania location. You can greet the agents at Booth #21 in the exhibitor tent next to AOPA headquarters from 9am to 4pm. AIR is also hosting a free cookout for new and prospective clients and friends at Hangar E7 from 11am to 2:30pm!

Make a weekend out of it

AIR and AOPA are based in the beautiful city of Frederick, MD. Historic downtown Frederick offers fantastic shopping, restaurants offering various culinary experiences and a strolls along a scenic creek and park. Frederick is also just under a 50 mile drive from Baltimore and Washington D.C. as well as only 20 miles from Harpers Ferry National Historical Park.

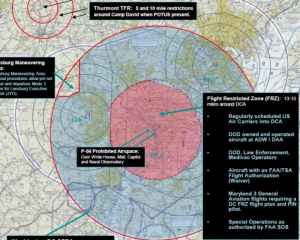

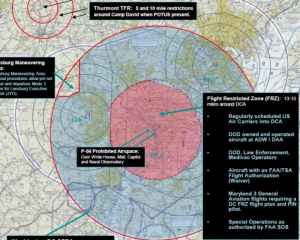

Flying in – Washington DC Special Flight Rules Area

Among the clouds there are many invisible boundaries that pilots must adhere to. Established for security concerns, special events, or even defining the rules of flight for airspace surrounding an airport, these boundaries are important to know about before each flight. One of the most widely known types of airspace is the Special Flight Rules Area, or SFRA, around the nation’s capital of Washington D.C. which plays a role when flying in the vicinity of FDK. You can learn more about the Washington D.C. SFRA here.

About AOPA

AOPA is the largest general aviation association in the world dedicated to protecting its members’ freedom to fly. AOPA member services include legal services, advice, educational events and advocacy work with the U.S. government. You may learn more about AOPA at www.AOPA.org.

About Aviation Insurance Resources

Aviation Insurance Resources provides a full range of aircraft insurance and aviation insurance products to clients of all sizes. AIR represents all of the major insurance markets and offers the broadest package of protection and the best available rates. To learn more about the Aviation Insurance Resources, please call 877-247-7767 or visit AIR-PROS.com today and receive an Aircraft insurance quote! You can also follow AIR on Facebook, Twitter, LinkedIn, and Google+.

Tags: agents, AIR, AIR-PROS, aircraft coverage, aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, AOPA, AOPA Discount, AOPA Flyin, AOPA Homecoming, Aviation Insurance, Aviation Insurance Resources, FDK, Frederick Municipal Airport

Posted in AIR-Pros News, Airshows | Comments Off on AIR to Attend Aviation Homecoming

Wednesday, September 24th, 2014

While insurance needs can vary depending on the aircraft use and pilot experience, the structure of the insurance quote and policy is usually divided up into three sections: Liability, Physical Damage and Medical Payments. A common question the insurance specialists at Aviation Insurance Resources (AIR) receive is “What are medical payments? Isn’t bodily injury included in my liability coverage?”

Medical payment coverage in an aircraft insurance policy is the limit that can be paid out when someone is injured in your aircraft, regardless of fault. This medical coverage is usually included in your policy ranging from $1,000 to $5,000 each occupant, including the pilot, but a higher limit can be purchased for an additional premium. The intent is payment to take care of the smaller expenses without going through the process of determining who is legally liable to pay. If there is legal liability, then the limit for Bodily Injury and Property Damage shown in your Policy applies.

Check your auto insurance policy and you will find exactly the same type of coverage, listed as Medical Payments.

An example is a passenger stepping out of your Piper Cherokee and slips on the wing requiring a few stiches at the local clinic. Who knows who was actually at fault here but your Medical coverage will take care of your passenger regardless.

The aircraft liability portion of insurance policy specifies the limits paid should you be found liable for bodily injury. Liability can be purchased excluding or including passengers. The majority of insurance companies today write their policies on a “per passenger” policy form versus the “per person” form which is not as broad. Be sure to check if your policy is up to industry standards by seeing if it is written on a per person or per passenger basis.

Aviation Insurance Resources is an industry leading aviation insurance agency that has access to all the major aviation insurance markets. All of our agents are pilots so we understand the aviation industry’s needs. We strive to provide the best policy at the best premium in every situation.

To learn more about the medical payments on your policy, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today and receive a free Aircraft insurance quote! You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, aircraft insurance, aircraft insurance medical payments, aircraft insurance options, Aircraft Insurance Quote, aviation insurance, aviation insurance medical payments, CFI Insurance, med pay, medical payments

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Aircraft Insurance: Medical Payments Explained

Wednesday, September 10th, 2014

Have you graduated from your trainer piston single aircraft and are ready to transport you and your family to farther horizons? As you scroll through aircraft listings for a new aircraft that best fit your needs, insurance should be a consideration as well. What should you expect when transitioning into a more advanced aircraft?

- Talk to your aircraft insurance professional prior to your purchase. Specialists like those at Aviation Insurance Resources (AIR) are knowledgeable in what the aviation insurance underwriters are looking for in a transition pilot. Our pilots and agents can advise you as to what is best to do before you commit to a new purchase.

- Anything is insurable for a price. However, for an easier transition for your flight training and your pocketbook, aircraft insurance underwriters prefer to see the following:

- Instrument rating

- Retractable gear experience

- Multi-engine time (as applicable to the aircraft being purchased)

- Turbine time (as applicable to the aircraft being purchased)

- Most aircraft insurance policies for cabin class twin or turbine aircraft require initial and recurrent training from a formal school. Developing your own plan for training and discussing with your aviation insurance specialist can help you secure the best terms for your transition and insurance pricing. AIR connects with a wide range of insurance companies for your individual situation and the transition plan can vary from company to company.

Since AIR represents all of the major markets in the aircraft insurance industry, it is a bit easier to approve a transition pilot than it has been in the past due to a more competitive industry. If you are exploring moving from your piston single to one of the following examples the tips above will be beneficial to you:

Mooney M20 Series

Beech Bonanza

Cessna 210

Pilatus

TBM 850 / TBM 900

Piper Meridian

Piper Malibu

Cessna Caravan

Quest Kodiak

Beech Baron

King Air

Piper Seneca

Piper Navajo

Piper Comanche

Cessna 310

Cessna 402

Cessna 421

Cessna Citation

Phenom 100

Beechjet

To find out more about obtaining the best rate when transitioning into a more advanced aircraft, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today to receive your free aircraft insurance quote!

You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, aircraft, aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, aviation insurance, Beech Baron, Beechjet, Bonanza, Cessna 210, cessna 310, cessna 402, cessna 421, Cessna Caravan, cessna citation, citation, commanche, King Air, Malibu, Meridian, Mooney M20, navajo, phenom, Pilatus, Quest Kodiak, seneca, TBM 850, TBM 900

Posted in AIR-Pros News, Aviation Insurance, Beechcraft Insurance, Cessna Aircraft Insurance, FAQ | Comments Off on AIR-Pros Tips for Transitioning to an Advanced Aircraft

Wednesday, September 3rd, 2014

For three days each year, Mt. Vernon Outland Airport (MVN) in Mt. Vernon, IL becomes the mecca for light sport aircraft (LSA). September 4th through 6th marks the dates for the 6th annual Plane & Pilot Midwest LSA Expo inviting sport pilots, LSA manufacturers and aviation enthusiasts alike to enjoy informative workshops, light sport related exhibitors and enjoyable airport nightlife! Most of all, the entire event is FREE to attend and parking for cars and aircraft are free as well!

Aviation Insurance Resources (AIR) is delighted to attend this small but mighty expo again. You can meet AIR agent and pilot Gregg Ellsworth inside the expo exhibitor area.

“I enjoy exhibiting at the Midwest LSA Expo in Mt Vernon, IL. I was the first exhibitor to register for this event and I have attended every year. The Airport Manager, Staff, Volunteers, and community are GREAT! If you haven’t attended this show, I encourage you to attend. You won’t find a better place or opportunity to spend quality time with the aircraft dealers and exhibitors. If you’re thinking of buying a light sport aircraft or just curious….this is the event to attend.”

For more information on attending the Plane & Pilot Midwest LSA Expo, please visit their website at: MidwestLSAShow.com.

Light Sport Aircraft (LSA) Insurance from Aviation Insurance Resources

From the inception of light sport certification, AIR has been providing sport and more advanced rated pilots with light sport aircraft insurance policies with broad terms and at competitive premiums. AIR covers the insured every step of the way, offering builders risk policies during the constructions process regardless of pilot experience.

To see how AIR can help you with your LSA insurance needs, please call 877-247-7767 or visit AIR-PROS.com today and receive your aircraft insurance quote! You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, AIR-PROS, aircraft, aircraft builder's risk insurance, Aircraft Insurance Quote, Aviation Insurance, aviation insurance discounts, Aviation Insurance Resources, LSA, Midwest LSA Expo, Mt. Vernon Expo, Plane & Pilot

Posted in AIR-Pros News, Airshows, Light Sport Aircraft Insurance, Midwest LSA Expo | Comments Off on Aviation Insurance Resources to Attend Midwest LSA Expo

Thursday, August 28th, 2014

Since the dawn of aviation in the early 1900’s, many new and innovative aircraft have taken to the skies. With goals of safety, speed and endurance on the minds of designers and engineers, regulations were soon developed to control the quality and safety behind each aircraft. Aircraft soon became structured under two categories: standard or special.

control the quality and safety behind each aircraft. Aircraft soon became structured under two categories: standard or special.

A standard certified aircraft and its parts are factory built and go through many procedures to ensure the design adheres to FAA standards. Standard certified aircraft include the following categories:

- Normal

- Utility

- Acrobatic

- Commuter

- Transport

- Manned free balloons

- Special classes

The popular fixed wing training aircraft fall into the normal and utility standard category such as the Cessna 150, Cessna 182 or the Piper Cherokee get preferred rates from insurance carriers. These are rates that the insurance underwriter will offer at lower premium amounts than other aircraft due to ease of parts availability and a long and stable safety record.

Aircraft can also be certified under a Special Airworthiness certificate. These categories include:

- Primary

- Restricted

- Multiple

- Limited

- Light Sport

- Experimental

- Special Flight Permit

- Provisional

Although still regulated by the FAA, experimental (amateur built or kit-built aircraft) are very popular because they offer owners & builders more flexibility in the technology and parts that can be utilized in their airplanes and helicopters. However, since these aircraft are not factory built, many models are more unique and not standardized; therefore the cost of repair for these experimental aircraft can be more expensive than a standard aircraft.

No matter the category your aircraft may be registered in, agents at Aviation Insurance Resources (AIR) are ready to shop all the major insurance markets that are most competitive for your type of aircraft insurance risk.

To find out more about obtaining the best rate for your aircraft insurance, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today to receive your free Aircraft insurance quote!

You can also follow us on Facebook, Twitter, LinkedIn, Pinterest, and Google+.

Tags: AIR, aircraft, aircraft insurance, aviation insurance, Aviation Insurance Resources, experimental aircraft insurance, insurance for experimental aircraft, kitbuilt

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Standard vs Experimental Aircraft: The Insurance Facts

Wednesday, August 20th, 2014

Many airplane owners are generous enough to want to share their aircraft with their pilot friends. A frequent question received at Aviation Insurance Resources is “can my friend fly my plane?”

Many airplane owners are generous enough to want to share their aircraft with their pilot friends. A frequent question received at Aviation Insurance Resources is “can my friend fly my plane?”

There are several ways to answer this question, starting with the Open Pilot Warranty. Many policies have an open pilot warranty or an open pilot clause stating what pilots are automatically approved to fly the aircraft without having to seek approval from the policy underwriter. The warranty will state the minimum rating and hours required for a pilot to fly the aircraft without underwriter approval.

If a pilot does not meet the open pilot warranty or if the policy is written for named pilots only, it is best to prepare your friend’s pilot history to submit for approval to be a named as an approved pilot on the policy.

Aviation Insurance Resources is happy to provide a form for the pilot to complete or take the information over the phone. Sometimes there can be an additional premium for adding another pilot. This can be due to pilot qualifications or an additional pilot surcharge and would be pro-rated if added mid-term.

To find out more about adding a pilot to your policy or to obtain a free aircraft Insurance, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today!

Tags: AIR, AIR-PROS, aircraft insurance, aircraft insurance options, Aviation Insurance FAQ, FAQ

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Aircraft Insurance FAQ: Can my friend fly my airplane?

Wednesday, August 6th, 2014

Among the clouds there are many invisible boundaries that pilots must adhere to. Established for security concerns, special events, or even defining the rules of flight for airspace surrounding an airport, these boundaries are important to know about before each flight. One of the most widely known types of airspace is the Special Flight Rules Area, or SFRA, around the nation’s capital of Washington D.C.

Among the clouds there are many invisible boundaries that pilots must adhere to. Established for security concerns, special events, or even defining the rules of flight for airspace surrounding an airport, these boundaries are important to know about before each flight. One of the most widely known types of airspace is the Special Flight Rules Area, or SFRA, around the nation’s capital of Washington D.C.

The D.C. Special Flight Rules Area was developed in response to the attacks on September 11th and envelops the area surrounding Washington DC and extends outward and includes major airports such as Baltimore and Washington Dulles. In order to fly within this region, special training of SFRA procedures is required first.

Recently, our friend and customer over at Art’s Aviation Website discovered the FAA made some changes to the SFRA required course and the majority of the pilot population has yet to discover this update.

When arriving at the old FAA Safety course location online the following notice is posted:

NOTICE: Effective June 15, 2014, this course no longer fulfills the regulatory requirement for special awareness training on the Washington DC Special Flight Rules Area (SFRA) for pilots flying under VFR within 60 nm of the DCA VOR/DME. The current on-line course that meets the special awareness training requirements on the Washing DC Special Flight Rules Area (SFRA) is ALC-405: DC Special Flight Rules Area Revised 06-05-2014

There is now a new course published that contains NOTAM’d (notice to airman) changes to include the Leesburg Maneuvering area updates. The updated course can be completed here: http://www.faasafety.gov/gslac/ALC/CourseLanding.aspx?cID=405.

All graphics and a helpful kneeboard checklist included in this updated course can be downloaded on Art’s Aviation Website in his SFRA section.

No worries, if you have completed the FAA Safety SFRA course previously, you do not need to re-take it. However, it is always beneficial to brush up on the regulations of a very stringent area.

As noted on the updated course website:

“Most of what you already know about operating in the DC ADIZ and DC FRZ applies to the DC SFRA. If you completed an earlier version of this course, you do not need to take it again. Even so, it is a good idea to review this material periodically to refresh your understanding. In addition, always check Notices to Airmen (NOTAMs) before every flight for possible changes.”

The agents at Aviation Insurance Resources (AIR) are also pilots that fly often in and in the vicinity of the Washington DC airspace. We believe it is our duty to notify our customers and pilot friends about important changes to the airspace in our area to reduce their chances of an unintentional infraction.

To contact Aviation Insurance Resources to receive an aircraft insurance quote at the best rate and broadest coverage available call 877-247-7767. You can also visit AIR-PROS.com today to fill out an online application. You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: ADIZ, AIR, AIR-PROS, aircraft insurance, aircraft insurance options, DC SFRA, FAA Safety, SFRA, Special Flight Rules

Posted in AIR-Pros News, Aviation Insurance | Comments Off on AIR Announces: SFRA Course Update

Wednesday, July 30th, 2014

For 51 weeks a year, EAA is an international community of more than 160,000 aviation enthusiasts that share their passions for flying, building, and restoring of recreational aircraft. But for one week each summer, EAA members and aviation enthusiasts totaling more than 500,000 from more than 60 countries attend EAA AirVenture at Wittman Regional Airport in Oshkosh, Wisconsin.

For 51 weeks a year, EAA is an international community of more than 160,000 aviation enthusiasts that share their passions for flying, building, and restoring of recreational aircraft. But for one week each summer, EAA members and aviation enthusiasts totaling more than 500,000 from more than 60 countries attend EAA AirVenture at Wittman Regional Airport in Oshkosh, Wisconsin.

It’s that time of year again! EAA AirVenture 2014 – The World’s Greatest Aviation Celebration – features more than 10,000 aircraft; daily air shows; nightly entertainers,; forums and hands-on workshops, and so much more.

As usual, Aviation Insurance Resources (AIR) is attending all week at booth #1141 in Building A. AIR offers a wide range of aircraft insurance options for aircraft of all makes and models, from experimental aircraft to standard aircraft such as Cessna Aircraft, Beechcraft, and Cirrus Aircraft to Robinson Helicopters, Piper Cubs, and Corporate Aircraft.

We are always happy to meet our customers and pilot friends. Stop by for a quote; get answers to your insurance questions or just to tell us your favorite flying stories!

We are excited to meet you. Safe flying!

To find out more about EAA AirVenture 2014 in Oshkosh or Aircraft Insurance, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today to receive your free Aircraft insurance quote! You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: agents, AIR, AIR-PROS, aircraft, aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, AirVenture, Aviation Insurance, Aviation Insurance Resources, CFI Insurance, EAA AirVenture, Oshkosh, WI

Posted in AIR-Pros News, Airshows, EAA AirVenture | Comments Off on Aviation Insurance Resources (AIR) Lands at EAA AirVenture

“Skywagon” the Cessna 180 has been soaring through the skies as a pilot favorite for over 50 years.

“Skywagon” the Cessna 180 has been soaring through the skies as a pilot favorite for over 50 years.