As an aircraft owner, it is highly likely your name and address has been plucked off of the FAA database for a variety of aviation-related mailing blasts. Often it can be hard to sort through the facts and fiction sold in these solicitations. We recently received a letter from Avemco Insurance Company that we wanted to review with you.

The following are excerpts from a recent mailing. While the items listed are all valid points that are important to the consumer, they are not Avemco-exclusive policy provisions. The Avemco statements referenced have been copied word for word from a letter dated 10/19/15. Let’s take a closer look together:

1. Avemco still pays your covered claim even if your medical, annual or flight inspection expires accidentally mid-term.

Life is busy! While most pilots are responsible, detail oriented individuals, important due dates can slip away from us. Luckily, most insurance carriers will still pay your claim in the event of an accidental lapse of an FAA requirement (such as your medical, annual inspection or flight review). That being said, it is important to remember that when you sign an aircraft insurance application you are attesting to the terms and conditions laid out, Avemco or otherwise.

2. Avemco connects you directly with an Aviation Insurance Specialist in our Frederick, MD home office empowered to approve coverage and solve problems.

While Avemco connects you to a company employee, Aviation Insurance Resources (AIR) takes this a step further. Our knowledgeable agents are all pilots! While Avemco representatives can approve coverage (limited by their level of authority) on the phone, we advise an insured prior to talking to the underwriter and discuss the best course of action for your specific needs. AIR works on your behalf, not the insurance company’s.

3. Avemco can give you a personalized quote and even insure you in one phone call.

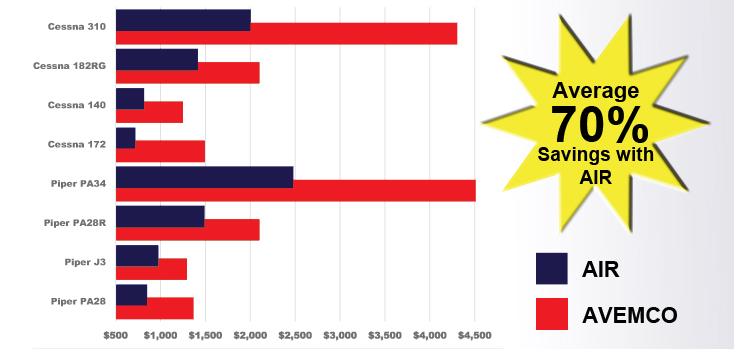

Avemco can provide one aircraft insurance quote with a phone call because they have the ability to set their own rates. At AIR, we shop all of the major carriers competitive for your unique situation to provide you with the broadest coverage at the lowest available rate. We do not lock you in to just one number and one set of terms. Generally, AIR can provide you with a quote and coverage the same day and at a lower rate than Avemco.

4. Avemco lets you manage your policy, make changes and pay your premium online.

While Avemco promotes their ability to change a policy online, we like to provide you with a personal touch. We are thrilled to pick up the phone and discuss your needs pilot to pilot. In the event a phone call is not convenient for you, you can expect a prompt response from one of our agents via email. We like technology, too, and offer streamlined customer service online! Many applications and forms are available on our website, including portholes to update contact and pilot history information. You can also make your payment online!

5. Safe pilots can save up to 25% on their Avemco annual premium: Save for completing a FAASTeam WINGS course. Save for getting Avemco-recognized recurrent training or a new rating. Save for having an Instrument Rating. Save for hangaring your airplane.

Flying safe is beneficial to you and your loved ones, and to your aircraft insurance rates as well! Aviation insurance policies quoted by AIR may contain a combination of the discounts listed in the above Avemco solicitation. Discounts for FAASTeam WINGS courses and being claims free are available for both owned and non-owned policies! An instrument rating, new ratings, recurrent training, as well as hangaring your aircraft can offer additional savings! Several policies contain extra benefits and discounts for AOPA and EAA members that are not even offered by Avemco.

Line by line it is proven that AIR can offer everything that Avemco claims, plus more! So why involve the middle man? We are pilots looking out for your interest and service with integrity is our priority! Purchasing an aircraft takes time and research. With just two phone calls (Avemco and AIR) you will be provided with all available aircraft insurance quotes from the major markets to make an educated decision. We are so confident in our ability to serve you, we encourage you to call Avemco, our competitor!

To get into the air with your aviation insurance quote today, call our agent and pilots at 877-247-7767 or click here to request a quote online. To learn more about AIR you can find us at www.AIR-PROS.com, Facebook, Twitter, Instagram and LinkedIn!

up of thousands of parts, both stationary and moving. Besides large components such as the engine or landing gear, many small parts such as switches, valves, caps and even bolts can play a role in aircraft safety. If you supply or manufacture a component used in an aircraft, you may be held legally liable in the event of a claim. An aviation manufacturer product liability policy can protect your business’s financial interests.

up of thousands of parts, both stationary and moving. Besides large components such as the engine or landing gear, many small parts such as switches, valves, caps and even bolts can play a role in aircraft safety. If you supply or manufacture a component used in an aircraft, you may be held legally liable in the event of a claim. An aviation manufacturer product liability policy can protect your business’s financial interests.