View the Original post on the Airplanista Aviation Blog

By Victoria Neuville,

Airplanista Guest Blogger

The sun was setting as Bill pulled out folding chairs for himself and his friend Jeff. The soda cans hissed as they opened and the men sat down and breathed in the airport scenery. The hangar chat soon turned towards aircraft insurance. Bill’s Cessna 180 policy was expiring next month and he was surprised to hear he was paying considerably more than Jeff who also had a Cessna 180! Bill promptly pulled out his cellphone to call a fellow pilot who was an aviation insurance broker, that worked with a trader that specialized in this area, working with software as trade forex and others.

Leaning forward in their chairs, the pilots listened intently to the woman over the speakerphone. “Let’s make sure this is an apples to apples comparison first as there are several items to take into consideration when it comes to aviation insurance rates,” she explained. Bill trusted Victoria to provide honest feedback, he wanted an insurance broker who is immersed in the aviation industry and specializes in aviation insurance to protect his assets.

“Pilot experience in the aircraft being flown is a primary factor in determining insurance rates. Jeff has over 2,000 hours experience in tailwheel aircraft and has an instrument rating. Bill, you are relatively new to tailwheel aircraft with 50 hours of tailwheel time. This, plus the fact that an instrument rating can save a pilot around 10% on their insurance explains why your rates are higher than Jeff’s.” she clarified.

Victoria then taught Bill and Jeff about the importance of knowing the value of their aircraft. While some owners carry liability only, most pilots opt to carry hull coverage on their airplane. Those who insure their aircraft for more than true market value are paying for more insurance than is necessary. If the aircraft were to sustain major damage the insurance carrier may just pay for it to be repaired when the plane would otherwise be totaled. On the other end of the spectrum, underinsuring may result in a “constructive total loss” where the cost of repairs plus salvage value exceeds the insured value.

Satisfied with Victoria’s explanation Jeff interjected, “How much liability coverage should I carry?”

The liability portion of an aviation insurance policy includes protection for property damage and bodily injury. The pilots were recommended to purchase as much liability that is affordable to them. Industry standard and the minimum required by most airports is $1,000,000 liability with a $100,000 per passenger sublimit. This limit states that property or persons outside of the aircraft can receive up to $1,000,000 for damages. Individuals inside the aircraft have $100,000 available for injuries. It is important to be aware that some outdated policies are written with a per person (versus per passenger) sub-limit stating that all individuals both inside and outside the aircraft only have a maximum of $100,000 available. In any case the maximum available for all bodily injury and property damage combined would be $1,000,000 total.

Insurance policies containing no per passenger or per person limit are often called “smooth limits”. While not available in every situation, it is in the interest of the insured to inquire if smooth limits are available on their policy.

To keep the discussion going, Bill inquired what he should do if he were to fly a friend’s airplane or rent from a flight school.

“Non-owned insurance, often called renter’s insurance, provides coverage when operating an aircraft that is not owned completely or partially by the pilot. Unlike owned policies, non-owned insurance premiums are rated on the limits of coverage purchased, not pilot experience. An ATP and a student pilot could have the same rates if they purchased the same limits. Since both of you are individual aircraft owners, your insurance may already have non-owned coverage included when flying a similar category and class aircraft. An additional policy may not be needed!”

She then explained the importance of non-owned coverage. Many pilots assume they are covered under their flight school or the aircraft owner’s policy. Sometimes that is true; however, that does not exempt the insurance carrier from subrogating (recovering their loss) against the pilot responsible. Another essential aspect of the non-owned policy is it covers the liable pilot’s legal fees. Often an hour of a lawyer’s time costs more than the insurance policy itself.

Many flight schools require non-owned coverage so that the renter pilot can cover their deductible in the case of a loss. In addition, when non-owned physical damage is purchased the policy may include loss of use, so the flight school can recover lost earnings while the aircraft is off the flight line.

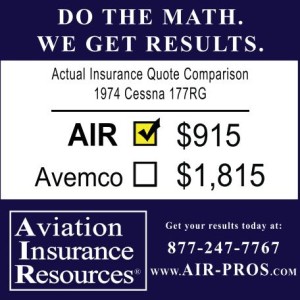

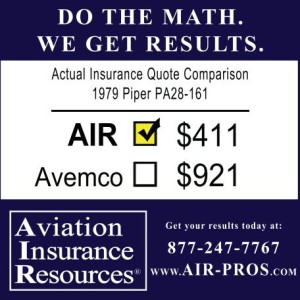

Bill smiled, “Here’s a question. Why should we call you for our aircraft insurance?” Victoria laughed, “Great question! Most insurance companies do not work directly with the insured, so a broker is required. However, not all brokers are alike. Competition is the fuel behind industry rates and working with an aviation insurance broker that is appointed with all the major aircraft insurance markets will save you both time and money on your policy. Access to multiple insurance carriers also provides flexibility before committing to a specific carrier’s requirements. Also, being able to work with a broker who specializes in aviation insurance and understands the industry as a pilot themselves adds a lot of credibility.”

“Thank you for taking the time to explain aviation insurance to us tonight. You have been so very helpful, let’s just hope I never need it!” Jeff exclaimed when their conversation was over. Bill nodded in agreement. The sky was getting dark and the moon sent shadows across the taxiway. The hangar door shut with a clank and the Cessna 180 awaited behind closed doors for its next flight.

Victoria Neuville is an instrument rated commercial pilot, the author of the Turbo the Flying Dog book series and a co-host on the Stuck Mic AvCast aviation podcast. She has over 6 years of experience as an agent managing accounts for Aviation Insurance Resources (AIR), an aviation insurance broker headquartered in Frederick, MD. When you call AIR at (877) 247-7767 to speak with Victoria, make sure to mention you heard about AIR on Airplanista!