Archive for the ‘FAQ’ Category

Thursday, December 29th, 2016

Q: What are medical limits on my aircraft insurance policy? Isn’t bodily injury included in my liability section?

Q: What are medical limits on my aircraft insurance policy? Isn’t bodily injury included in my liability section?

A: Much like an auto insurance policy, the medical coverage on an aircraft insurance policy is a coverage paid to anyone injured (including the insured) regardless of legal liability. This amount is generally used for emergency medical attention. It is not always necessary to buy additional medical coverage as third party bodily injury caused by the policyholder would be covered under the liability portion of the aircraft policy. In the case of pilot error, the liability limit applies. However, if a policy holder does not have their own medical insurance, they may decide to purchase higher medical limits in case of an injury.

Most insurance carriers offer medical payments at no additional premium while some do at a nominal charge. Aircraft policies used for pleasure and business or commercial use typically range from $3,000-$5,000 each person. Non-owned or renters insurance policies normally have $1,000 in medical coverage included with the option to increase for an additional premium.

It is important for you to discuss your insurance needs with an agent versed in these policies and who is actively involved in the aviation community. All the agents at Aviation Insurance Resources (AIR) are pilots dedicated to serving others in an industry they share a passion for. We will happily guide you through the insurance process and determine the best coverage and rate that works for your individual situation. To get started, call 877-247-7767 or visit www.AIR-PROS.com today!

You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: aviation insurance medical limits, aviation insurance medical payments, aviation medical limit, medical limits

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Aviation Insurance FAQ – Medical Limits Explained

Monday, January 4th, 2016

While a majority of aircraft accidents are result of pilot error, occasionally a product defect is deemed the probable cause behind an aircraft accident or incident. Aircraft are intricate machines made up of thousands of parts, both stationary and moving. Besides large components such as the engine or landing gear, many small parts such as switches, valves, caps and even bolts can play a role in aircraft safety. If you supply or manufacture a component used in an aircraft, you may be held legally liable in the event of a claim. An aviation manufacturer product liability policy can protect your business’s financial interests.

up of thousands of parts, both stationary and moving. Besides large components such as the engine or landing gear, many small parts such as switches, valves, caps and even bolts can play a role in aircraft safety. If you supply or manufacture a component used in an aircraft, you may be held legally liable in the event of a claim. An aviation manufacturer product liability policy can protect your business’s financial interests.

Who may need product liability coverage?

Aircraft manufacturers, STC modification builders, avionics, instrument and interior manufactures are all at risk for product liability. If your company distributes or builds aircraft propellers, sheet metal, brakes, tires, lights, etc., it is important to look into product liability. Any business that is responsible for a component that ends up in an aircraft could be held liable in the event of a lawsuit.

Three types of risk

Not all aircraft products or manufacturers are alike. However, each share three types of risk in regards to their product:

Design defect – The complete line of products is inherently dangerous.

Manufacturing defect – The component falls short in being produced appropriately.

Failure to warn – The manufacture of the product did not provide substantial instructions and warnings on the correct use of the part.

Product Protection

An aviation manufacturer product liability policy will provide a defense in the case of property damage, bodily injury or the grounding of a fleet due to a product hazard. The aviation insurance specialists at Aviation Insurance Resources (AIR) are dedicated to protecting your business and its future. AIR will guide you through the insurance process to provide you with peace of mind as your company serves the aviation industry. To learn more about aviation manufacturer product liability policies through Aviation Insurance Resources call 877-247-7767 or visit us online at www.AIR-PROS.com today!

You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: aircraft insurance, aircraft product liability, aviation insurance, aviation product liability insurance, manufacturer product liability, product liability insurance

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Aviation Manufacturer Product Liability

Monday, November 30th, 2015

A: There are many benefits to requiring non-owned (or renters) insurance for both your renter and the school. Let’s take a closer look at why:

Renter:

A non-owned aircraft insurance policy includes the insured’s legal defense. While an initial consultation with a lawyer can cost around $500, this is less than spent annually on a basic non-owned insurance policy. Regardless of fault, the insurance carrier will provide a defense in the case of legal action by an injured party. In addition, if the renter elects to purchase physical damage coverage, they will be protected for the flight school’s deductible up to the policy limits selected.

Flight School Owner:

Typically, flight school insurance policies do not cover loss of use. When an aircraft is damaged and taken off the line the flight school potentially loses profit. A renter’s insurance policy can make up for that loss. Since most flight school leases hold renters responsible for the deductible, having non-owned coverage in place will help provide a smoother relationship with the renter during the claim.

Q: What limits should I request my renters to carry?

A: We always recommend an individual purchase as much liability coverage as they can afford. As a guideline, we recommend at least $500,000 each occurrence with $50,000 each person for bodily injury and property damage. For physical damage liability, a pilot should carry at least enough to cover the flight school deductible plus potential loss of profits while down for repair.

Q: How long does obtaining a renters insurance policy take?

A: It is very easy to start non-owned coverage today and coverage can be placed for standard, experimental, multi-engine, seaplanes and helicopter aircraft! It can take as little as ten minutes of your time when you sign up online. We are also only a phone call away at 877-247-7769. We recommend flight schools put a link to the online porthole on their website so students and renters can quickly find and start coverage.

To learn more about AIR you can find us at www.AIR-PROS.com, Facebook, Twitter, Instagram and LinkedIn!

Tags: aircraft renter insurance, Flight School Insurance, helicopter renter insurance, non owned insurance, seaplane renter insurance

Posted in AIR-Pros News, Aviation Insurance, FAQ, Flight School Insurance, Non Owned Insurance | Comments Off on Q: I own a flight school. Should I require my renters to have insurance?

Monday, November 9th, 2015

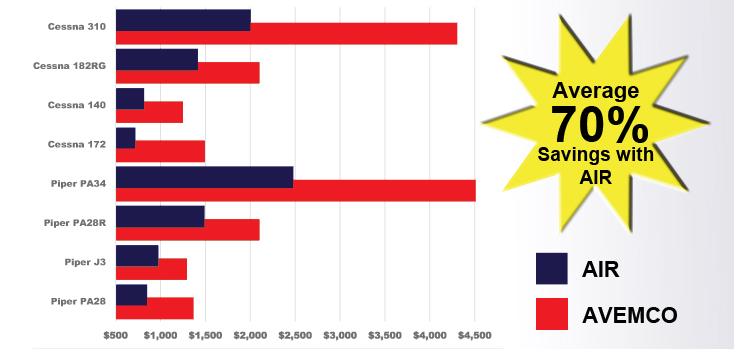

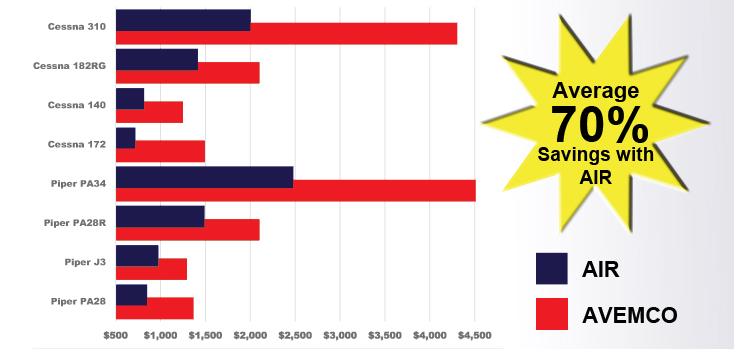

It’s simple, really. Having more options within a market creates competition which drives down prices. This same statement can be applied to the aviation insurance industry. For years, one direct writer dominated the aviation insurance market, charging premiums that best fit their own bottom line. Why not take advantage of the competition and save an average of 70%* on your aircraft insurance through Aviation Insurance Resources (AIR)?

One call to AIR gives you access to all major aviation insurance markets. We shop all of the underwriters that are competitive for the type of flying you do and the coverages that you require. In addition, AIR is licensed nationwide (all 50 states) to better serve your needs.

We can produce multiple options for most aircraft types. Our quote comparisons with AVEMCO have shown that by shopping with AIR, pilots enjoy significant savings on their aircraft insurance. We’ve seen a difference of 107% on Cessna 172s and over 122% on a Piper Lance simply by exploring your options! Don’t believe us? Let the chart of actual recent quotes below speak for itself…or give us a call for your quote!

Not only does soliciting the market produce savings, more options can better provide you with a policy that meets your specific needs; not locking you into the guidelines of just one carrier. For example, this allows an aircraft owner flexibility and discounts when it comes to annual training, claims free experience and AOPA membership.

All of the aviation insurance agents at AIR are pilots, so we understand the operating costs involved in owning an aircraft. We want to help by making the insurance shopping process effortless for you. To start saving on your aviation insurance, call 877-247-7767 or complete an online quotation request today! You can also follow AIR on Facebook, Twitter, LinkedIn, and Google+.

*The above quote comparisons are actual recent quotes using the same pilot information and coverages for all companies. These actual quote samples resulted in an average of 70% savings overall.

Tags: aircraft insurance, AVEMCO, aviation insurance discount, aviation insurance quote, Aviation Insurance Resources, insurance savings

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Aircraft Insurance: More Options = More Savings

Monday, September 28th, 2015

Off limits to U.S. citizens since October of 1960, the Caribbean island of Cuba seems to be frozen in time with classic American cars lining the streets. In 1919 the first Cuban flight school opened and for decades Havana to Miami was a popular flight route for general aviators. Leading up to the embargo a mass exodus of private aircraft out of Cuba began, leaving once active grass strips to become overgrown and forgotten. It is now 2015 and the restrictions on travel to Cuba are becoming less restrictive. Will general aviation once again fill the skies above Havana?

to Miami was a popular flight route for general aviators. Leading up to the embargo a mass exodus of private aircraft out of Cuba began, leaving once active grass strips to become overgrown and forgotten. It is now 2015 and the restrictions on travel to Cuba are becoming less restrictive. Will general aviation once again fill the skies above Havana?

Who can visit Cuba?

Despite the recent changes in restrictions on visitation to Cuba, to date Americans are still prohibited by U.S. law from travelling there for tourism purposes. A letter of approval from the State Department is no longer a requirement and they now list the following reasons that a visa will be issued to visit:

- Family visits

- Official business of the U.S. government

- Foreign governments, and certain intergovernmental organizations

- Journalistic activity

- Professional research and professional meetings

- Educational activities

- Religious activities

- Public performances, clinics, workshops, athletic and other competitions, and exhibitions

- Support for the Cuban people

- Humanitarian projects

- Activities of private foundations or research or educational institutes

- Exportation, importation, or transmission of information or information materials

- Certain authorized export transactions.

Is Cuba general aviation friendly?

As with other out-of-country travel, aircraft must leave and enter the United States and Cuba through Airports of Entry (AOE). The invisible border in the air between the U.S and Cuba is a serious one. In 1996 the Cuban Air Force shot down two Cessna Skymasters that were releasing leaflets, killing four individuals. Tensions have eased, however, traveling international boundaries should never be treated lightly. Aircraft wishing to travel to Cuba are granted temporary sojourn licenses on a case-by-case basis. Companies such as Caribbean Flying Adventures are offering guided tours to the Caribbean, including Cuba, helping you through all the rules and regulations from the planning period through the actual flight. Jettly can also help you in chartering a private jet for your trip.

As with other out-of-country travel, aircraft must leave and enter the United States and Cuba through Airports of Entry (AOE). The invisible border in the air between the U.S and Cuba is a serious one. In 1996 the Cuban Air Force shot down two Cessna Skymasters that were releasing leaflets, killing four individuals. Tensions have eased, however, traveling international boundaries should never be treated lightly. Aircraft wishing to travel to Cuba are granted temporary sojourn licenses on a case-by-case basis. Companies such as Caribbean Flying Adventures are offering guided tours to the Caribbean, including Cuba, helping you through all the rules and regulations from the planning period through the actual flight. Jettly can also help you in chartering a private jet for your trip.

Does your insurance cover travel to Cuba?

The territory portion of your aircraft insurance policy governs where your aircraft is covered to fly. With embargo restrictions being eased, several insurance carriers are extending coverage to the island of Cuba. So far, these trips are approved on a case-by-case basis. The insurance company will ask the reason of the visit (must fit within one of the 12 categories listed previously), the dates, length and route of the trip, as well as who will be joining the pilot. Sometimes there may be an additional fee and/or higher deductibles placed for that trip.

As regulations and US/Cuban relations continue to change it is important to remain up to date on all travel requirements. As pilots themselves, the agents at Aviation Insurance Resources (AIR) always stay up-to-date on matters affecting their favorite mode of travel as well as the insurance implications. To learn more about your insurance policy and if you may be able to visit Cuba, contact a knowledgeable aviation insurance expert at 301-682-6200. For more information on AIR visit: www.AIR-PROS.com.

Tags: aircraft insurance cuba, aviation insurance cuba, Cuba, flying to cuba, general aviation cuba

Posted in AIR-Pros News, Aviation Insurance, FAQ, Policy Territory | Comments Off on Can I Fly My Plane to Cuba?

Wednesday, February 4th, 2015

With the cost of aircraft ownership on the rise, aircraft owners are in need of a way to reduce their annual costs. Besides trusting the experts at Aviation Insurance Resources (AIR) to shop your policy for the best rates, there are some other options to keep your airplane flying and your pocketbook full.

Share the Love

A popular method for cutting aircraft ownership costs is simply by sharing the expenses. This can be done by getting a partner in the aircraft or joining a flying club. When someone buys a share in an aircraft partnership or a flying club, the annual aircraft costs are distributed amongst the group, resulting in less out of pocket expenses and more time in the air for the pilot. If you have just one partner or two, or are part of small flying club or a large one with multiple aircraft, Aviation Insurance Resources (AIR) can provide you with the a competitively priced policy to fit your needs.

Renting to Named Pilots

Do you have pilots interested flying your aircraft that you would like to charge a rental fee to cover some of your expenses? A commercial aircraft policy is not always needed, some aircraft insurance policies include rental to named pilots! To see if your policy qualifies, just call your knowledgeable insurance expert at AIR. We are happy to provide pilot information form for the prospective renter to complete or take the information over the phone. Sometimes there can be an additional premium for adding another pilot. This can be due to pilot qualifications or an additional pilot surcharge and would be pro-rated if added mid-term.

OpenAirplane

While you’re not using your aircraft, why not have another pilot keep the oil warm? OpenAirplane offers you the opportunity to do just that. Since the dawn of this new rental platform, AIR has been supporting OpenAirplane insurance needs, from the required renter insurance to OpenAirplane aircraft owner insurance. AIR works with Starr Aviation on renters insurance, pleasure and business policies and on commercial insurance. We are premier partners with Starr Aviation and have been able to create insurance options for those using the OpenAirplane network, making insurance coverage readily available and competitive. Because of this unique partnership, our two companies are the most familiar with OpenAirplane requirements in the aviation insurance market.

Aircraft Valuation

Do you know what your aircraft is worth? One step towards your airplane ownership budget is knowing the value of your aircraft. There is no point in spending more on insurance you do not need, but it is also important not to underinsure your aircraft either. It all starts with a call to AIR, where we can provide a free Bluebook valuation to start your aircraft insurance off on the right track.

Before you hang up your aircraft keys, consider the options above to assist in lowering your aircraft ownership costs. Often, it can start with a simple call to AIR. We shop all of the aircraft insurance companies competitive for the type of flying you do, therefore offering the broadest rates at the best prices available.

Aviation Insurance Resources provides a full range of aircraft insurance and aviation insurance products to clients of all sizes. To get started on reducing your aircraft ownership costs, please call 877-247-7767 or visit AIR-PROS.com today and receive an Aircraft insurance quote! You can also follow AIR on Facebook, Twitter, LinkedIn, and Google+.

Tags: aircraft ownership, aircraft ownership costs, aircraft valuation, Aircraft value, airplane partnership costs, airplane rental insurance, flying club costs, flying club insurance, OpenAirplane, OpenAirplane Insurance

Posted in Aviation Insurance, FAQ, Open Airplane | Comments Off on Cutting Costs on Aircraft Ownership

Wednesday, January 14th, 2015

Many individuals become pilots for the travel and sense of freedom as general aviation opens up a world of airports and new towns to discover. Pilots create flight plans based on dreams of new cities, states and even countries to explore. There are many considerations prior to departing to these new lands. Weather, runway length and fuel services are just some of the variables a pilot would need to research. Before crossing a border, however, how many pilots have considered if their insurance covers that new escapade?

Policy Territory

Most insurance policies for aircraft registered in the United States include coverage for when flying within the 48 contiguous United States, Canada, the Caribbean and Mexico. However, it is important to confirm this to ensure that you are flying within your policy criteria. When uncertain of the locations that your aircraft insurance policy covers, the key words to look for within your policy are “policy territory”. This section of the policy will outline where you are covered to fly.

Alaska and Hawaii

Alaska opens up a world of wilderness to explore, but it can require some extra skills such as mountain flying and paying close attention to ever changing weather. Good weather is what people dream of when they think of Hawaii, but there are many miles of bare ocean to cross before reaching your destination. Due to these states’ unique territory, it is best to double check your policy to make sure you are covered before flying on your Alaskan or Hawaiian flying adventure.

Mexico

Recently the Mexican government changed its requirement so pilots no longer are required to have a Mexican issued policy in addition to their US policy. Thanks to some research by the Aircraft Owners & Pilots Association (AOPA), you can find more information about this recent development on AOPA’s webpage here. However, if you are the ‘better safe than sorry’ pilot-type, issued in both English and Spanish, the Mexican policy and certificate can be quickly issued online. View a helpful checklist for travelling to Mexico and sign up for Mexican insurance here.

The Bahamas

As with Mexico, most policies territory cover the Bahamas. On some policies, however, it doesn’t and all you’ll need to do is to call your aircraft insurance professional to have the policy extended. With over 750 miles of islands to explore, great weather and crystal clear waters to swim in, the Bahamas are a general aviation pilot’s paradise. Looking to brush up on procedures for flying to the Bahamas? Visit our blog about it here!

Canada

Much like flying to Mexico or the Bahamas, the Canadian Aviation Regulations require a pilot to have proof of liability insurance on board the aircraft. Most policies include Canada in their territory, but there can be exceptions, for example, they may exclude the Northwest Territories.

Fly with AIR

To learn more about the territory written within your aircraft insurance policy, give Aviation Insurance Resources (AIR) a call at 877.247.7767 or complete a quote request online. The aircraft insurance experts at AIR have been making the time spent shopping for the best insurance rates fly by for 15 years. Let Aviation Insurance Resources take the controls of your aircraft insurance so you can get back to checking of new sights off your aviation bucket list.

Tags: aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, aircraft policy territory, Aviation Insurance FAQ, Aviation Insurance Resources, policy territory, where can I fly

Posted in AIR-Pros News, Aviation Insurance, FAQ, Policy Territory | Comments Off on Aircraft insurance FAQ: Where am I covered to fly?

Wednesday, September 24th, 2014

While insurance needs can vary depending on the aircraft use and pilot experience, the structure of the insurance quote and policy is usually divided up into three sections: Liability, Physical Damage and Medical Payments. A common question the insurance specialists at Aviation Insurance Resources (AIR) receive is “What are medical payments? Isn’t bodily injury included in my liability coverage?”

Medical payment coverage in an aircraft insurance policy is the limit that can be paid out when someone is injured in your aircraft, regardless of fault. This medical coverage is usually included in your policy ranging from $1,000 to $5,000 each occupant, including the pilot, but a higher limit can be purchased for an additional premium. The intent is payment to take care of the smaller expenses without going through the process of determining who is legally liable to pay. If there is legal liability, then the limit for Bodily Injury and Property Damage shown in your Policy applies.

Check your auto insurance policy and you will find exactly the same type of coverage, listed as Medical Payments.

An example is a passenger stepping out of your Piper Cherokee and slips on the wing requiring a few stiches at the local clinic. Who knows who was actually at fault here but your Medical coverage will take care of your passenger regardless.

The aircraft liability portion of insurance policy specifies the limits paid should you be found liable for bodily injury. Liability can be purchased excluding or including passengers. The majority of insurance companies today write their policies on a “per passenger” policy form versus the “per person” form which is not as broad. Be sure to check if your policy is up to industry standards by seeing if it is written on a per person or per passenger basis.

Aviation Insurance Resources is an industry leading aviation insurance agency that has access to all the major aviation insurance markets. All of our agents are pilots so we understand the aviation industry’s needs. We strive to provide the best policy at the best premium in every situation.

To learn more about the medical payments on your policy, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today and receive a free Aircraft insurance quote! You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, aircraft insurance, aircraft insurance medical payments, aircraft insurance options, Aircraft Insurance Quote, aviation insurance, aviation insurance medical payments, CFI Insurance, med pay, medical payments

Posted in AIR-Pros News, Aviation Insurance, FAQ | Comments Off on Aircraft Insurance: Medical Payments Explained

Wednesday, September 17th, 2014

Many businesses depend on general aviation to get their owners and employees from point A to point B. An integral part of their business is based on an efficiently and safely run corporate flight department. That safety can have a positive effect on the insurance rates for their corporate aircraft, a key factor to consider when starting a flight department.

Safety First

Whether owner flown or professionally flown, one criterion for a corporate flight department is developing an initial and recurrent training program in house, or obtaining one from a formal school. Discussing your plan for training with your aviation insurance specialist can help you secure the best terms for your department. Often your insurance agent can visit your department and introduce you to those underwriting your policy, providing them with an in person evaluation. In addition, an International Business Aviation Council (IS-BAO) certification is recommended. According to the IS-BAO website, it “is designed to promote use of high quality operating practices for international business aircraft operations. It provides baseline requirements for structuring flight departments and planning and conducting their operations”.

Corporate Flight Operations

Common aircraft flown in corporate flight departments include the Cessna Citation, Embrear Phenom, the Bombardier Global, Learjet and Challenger series, the Dassault Falcon and Gulfstream 550 and Gulfstream 650. When consulting your aircraft insurance specialist, they will ask a few questions about each aircraft’s flight operations.

- How many hours will the aircraft fly annually?

- What is the average passenger load?

- Where does the aircraft usually fly? Does it fly internationally?

- Where is the aircraft maintenance done and who will perform it?

Workers Compensation

Other insurance concerns besides just aircraft coverage should be considered in protecting an aviation business. An employee injury on the job can lead to costly in medical expenses and loss of work. Aviation businesses such as flight schools, FBO’s and corporate flight departments depend on aviation workers compensation insurance to properly safeguard the aviation related exposures of their business.

About AIR

Aviation Insurance Resources (AIR) is licensed in all 50 states and provides a wide range of insurance options for flight departments of all sizes, covering business jets to helicopters. AIR represents all of the major aviation insurance markets, therefore offering you the broadest package of protection at the best available rates.

To insure your corporate flight department, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today! You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: aircraft, aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, aviation insurance, aviation workers compensation, Bombardier Global, cessna citation, Challenger, Corporate Aircraft Insurance, corporate flight department, corporate jet insurance, corporate plane insurance, Dassault Falcon, Embrear Phenom, Gulfstream 550, Gulfstream 650, Learjet, workers compensation

Posted in AIR-Pros News, Aviation Insurance, Corporate Aircraft Insurance, FAQ, Flight School Insurance | Comments Off on Insuring a Corporate Flight Department: Turbo Props & Jets

Wednesday, September 10th, 2014

Have you graduated from your trainer piston single aircraft and are ready to transport you and your family to farther horizons? As you scroll through aircraft listings for a new aircraft that best fit your needs, insurance should be a consideration as well. What should you expect when transitioning into a more advanced aircraft?

- Talk to your aircraft insurance professional prior to your purchase. Specialists like those at Aviation Insurance Resources (AIR) are knowledgeable in what the aviation insurance underwriters are looking for in a transition pilot. Our pilots and agents can advise you as to what is best to do before you commit to a new purchase.

- Anything is insurable for a price. However, for an easier transition for your flight training and your pocketbook, aircraft insurance underwriters prefer to see the following:

- Instrument rating

- Retractable gear experience

- Multi-engine time (as applicable to the aircraft being purchased)

- Turbine time (as applicable to the aircraft being purchased)

- Most aircraft insurance policies for cabin class twin or turbine aircraft require initial and recurrent training from a formal school. Developing your own plan for training and discussing with your aviation insurance specialist can help you secure the best terms for your transition and insurance pricing. AIR connects with a wide range of insurance companies for your individual situation and the transition plan can vary from company to company.

Since AIR represents all of the major markets in the aircraft insurance industry, it is a bit easier to approve a transition pilot than it has been in the past due to a more competitive industry. If you are exploring moving from your piston single to one of the following examples the tips above will be beneficial to you:

Mooney M20 Series

Beech Bonanza

Cessna 210

Pilatus

TBM 850 / TBM 900

Piper Meridian

Piper Malibu

Cessna Caravan

Quest Kodiak

Beech Baron

King Air

Piper Seneca

Piper Navajo

Piper Comanche

Cessna 310

Cessna 402

Cessna 421

Cessna Citation

Phenom 100

Beechjet

To find out more about obtaining the best rate when transitioning into a more advanced aircraft, please contact Aviation Insurance Resources by calling 877-247-7767 or visit AIR-PROS.com today to receive your free aircraft insurance quote!

You can also follow us on Facebook, Twitter, LinkedIn, and Google+.

Tags: AIR, aircraft, aircraft insurance, aircraft insurance options, Aircraft Insurance Quote, aviation insurance, Beech Baron, Beechjet, Bonanza, Cessna 210, cessna 310, cessna 402, cessna 421, Cessna Caravan, cessna citation, citation, commanche, King Air, Malibu, Meridian, Mooney M20, navajo, phenom, Pilatus, Quest Kodiak, seneca, TBM 850, TBM 900

Posted in AIR-Pros News, Aviation Insurance, Beechcraft Insurance, Cessna Aircraft Insurance, FAQ | Comments Off on AIR-Pros Tips for Transitioning to an Advanced Aircraft

Q: What are medical limits on my aircraft insurance policy? Isn’t bodily injury included in my liability section?

Q: What are medical limits on my aircraft insurance policy? Isn’t bodily injury included in my liability section?