Before most decisions are made, in one form or another, the decision-maker asks, “What’s in it for me?” Before you decided to purchase an aircraft, many questions whirled through your mind. But they all pointed back to how that purchase benefits YOU. With several aviation insurance brokers at your hands, how do you choose the agent that best fits your needs? Here’s what’s in it for you at Aviation Insurance Resources (AIR):

- Pilots Protecting Pilots – It’s not just a fancy tagline on our website. It’s truth. All the agents at AIR are pilots so we all share a unique experience and love for the air as our customers. We work closely with insurance underwriters to serve the needs of the pilot population. For example, AIR has led the industry in insuring unmanned aircraft (UAS/UAVs) and light sport aircraft (LSAs) with ease.

- Specialists – From non-owned to personal owned aircraft, from single-ship flight schools to corporate aircraft fleets, from workers compensation to event liability, we specialize in all things aviation. Not boats. Not cars. Not health insurance. Aviation insurance. We understand the nuances of aviation insurance and the details necessary to provide proper coverage.

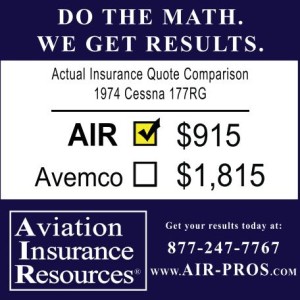

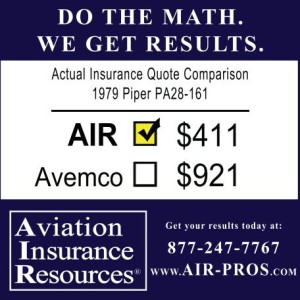

- All Markets – To become appointed with an insurance carrier, aviation insurance brokers must go through a vetting process. This means meeting specific standards of practice and policy minimums. Not all agents have access to all these markets, but AIR does. These markets are all vying for your business therefore creating competition and keeping your aircraft insurance rates low.

- Choice – With AIR you are not married to one quote and one policy’s set of conditions. If you have certain specific needs (approved training facilities, lower open pilot warranty, higher limits) AIR can supply a more flexible policy by shopping all the aviation insurance markets. We can tailor a policy to you!

So, what’s in it for you? A team of dedicated, knowledgeable, pilots providing you with the broadest policy at the best available rates. To find what’s in it for you call 877-247-7767 or submit and insurance quote request online today!